The Council for Affordable and Rural Housing (CARH) serves stakeholders in the affordable housing industry through the latest education, training, networking opportunities, and advocacy of key interests. We provide our members with the support needed so they can continue their work to ensure that low-income residents of rural America have access to safe, reliable, and affordable housing. Rural housing naturally tells a story – Every time a new family moves into an affordable home, we have the opportunity to ask our audience, “if this family didn’t have this home, where would they be?”

CARH Newsroom

CARH Newsroom

2026 Midyear Meeting

January 26 – 28, 2026

Cheeca Lodge & Spa

Islamorada, Florida

Meeting Brochure/Agenda

Registration Form

Hotel Reservations

Sponsorship Form

CARH Advocacy Tool

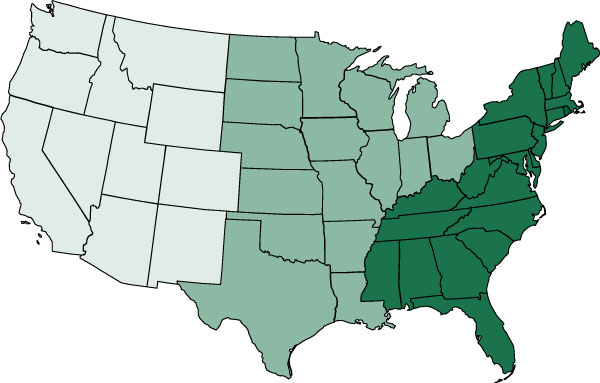

Click on the Map for CARH’s updated Advocacy Tool. Created by Affordable Housing Online, this tool is a searchable engine that maps low-income properties in the United States, by State, County, or Congressional District.

CARH, in partnership with ApartmentSmart.com and Affordable Housing Online, is continuing to build on this database to include more features as well as other federal properties.

If your property information needs updated or you have any questions, please email CARH.

Become a Member of CARH

Join the nation’s premier advocate for participants in the affordable rural housing profession.

Tax Credit Percentages

The IRS publishes monthly credit percentages that apply to low-income housing tax credit buildings placed in service that month. There are two rates: the 70% present value credit (PVC) and the 30% present value credit. The maximum 70% rate is available for low-income new construction and substantial rehabilitation expenditures that are not federally subsidized. The maximum 30% rate applies to acquisition expenditures and to federally subsidized low-income new construction or substantial rehabilitation expenditures.